40+ can you put closing costs into mortgage

This means that if you take out a mortgage worth 200000 you can expect closing costs to be about. So in this example the current mortgage of 200000 could be ported but we would need to add.

5 Important Things To Know About Fha Loans

Web Closing costs are the final costs that borrowers in Canada must pay at the closing of their loan to finalize the mortgage agreement and take possession of the home that has been.

. Come find your low-rate mortgage. Web Instead of rolling your closing costs into your mortgage you could also ask for lender credits or seller concessions. Web A prepayment privilege is the amount you can put toward your mortgage on top of your regular payments without having to pay a prepayment penalty.

Typically homebuyers spend between 2 and 5 of the. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with. These are the Closing costs and can run between 2 to 5 of.

Get Personalized and Expert Advice. Its Quick Easy and Free. Compare Fixed Tracker Rates.

Web Closing costs can make up about 3 6 of the loan amount. Web Options For Paying Loan Closing Costs Closing costs can quickly add up when you buy a house usually running between 3 and 4 of the purchase price. Web Closing costs accompany mortgage loans and cover the last-minute expenses and fees to close a loan.

First Time Home Buyer Mortgage. Web Total Mortgage needed 750000 275000. The downside of rolling closing costs into a loan is that you.

And Lock In Your Rate For 130 Days. You Might Be Eligible For First Time Discounts. Web In most cases they have to be paid upfront and cannot be rolled into your mortgage.

Your loan estimate should include your closing costs so you know what fees to expect. Allows closing costs to be rolled into the loan along with seller concessions of up to 6 percent. Before breaking your mortgage contract find out if.

These costs can be significant totaling as much as. Web Here are the guidelines for other types of mortgages. While budgeting for your home purchase youll want to.

Lock in your rate for up to 120 days. This fee can cost thousands of dollars. Web When youre buying a home one of the things you have to factor into your budget are closing costs.

Web According to RBC you should budget about 3 of your homes purchase price thats about the average closing costs for a mortgage in Canada. Web If you break your closed mortgage contract you normally pay a prepayment penalty. Web Closing costs explained Closing costs are one-time fees associated with the sale of a home generally provided to the buyer for payment three days before the home purchase.

Web In fact you can expect to pay around 2 to 5 of the value of the home in closing costs so thats thousands -- or even tens of thousands -- of dollars. Here is a rundown of the closing costs that may. Both can give you a little break on your.

Generally it is a good idea to budget between 3 and 4 of the purchase. Ad We can help you save more over your mortgage term. This is also known as rolling closing costs into a loan.

Web At this point the buyer has to pay the fees for the services and expenses for finalizing the mortgage. Web Any fees that go over the price of the property itself are called closing costs and include fees such as appraisal fees title insurance credit report fees legal fees and. Save even more with our Best Prepayment Privileges.

Ad Get Up To 4200 Cash Back With A New BMO Mortgage. Web Yes closing costs can be included in a mortgage loan. Ad Estimate Your Mortgage Payments.

Get Pre-Qualified Online In A Minute And Lock In Your Rate For 130 Days Learn More. Ad Are You Looking To Buy Your First Home. Connect With a Mortgage Advisor.

Web While closing costs for the buyer can vary depending on the mortgage lender property type and location they typically sit between 15- 4 of the value of the. One common mistake is overlooking the closing costs that need to be paid at the end of the buying process. Web Generally speaking you can expect to pay anywhere from 2 to 5 on closing costs when you buy a home.

Web 352 - 253. Web Typically closing costs range from 2 to 5 of a borrowers loan amount.

No Closing Cost Refinance Is It Right For You Nerdwallet

Is A Reverse Mortgage A Hoax Know The Facts

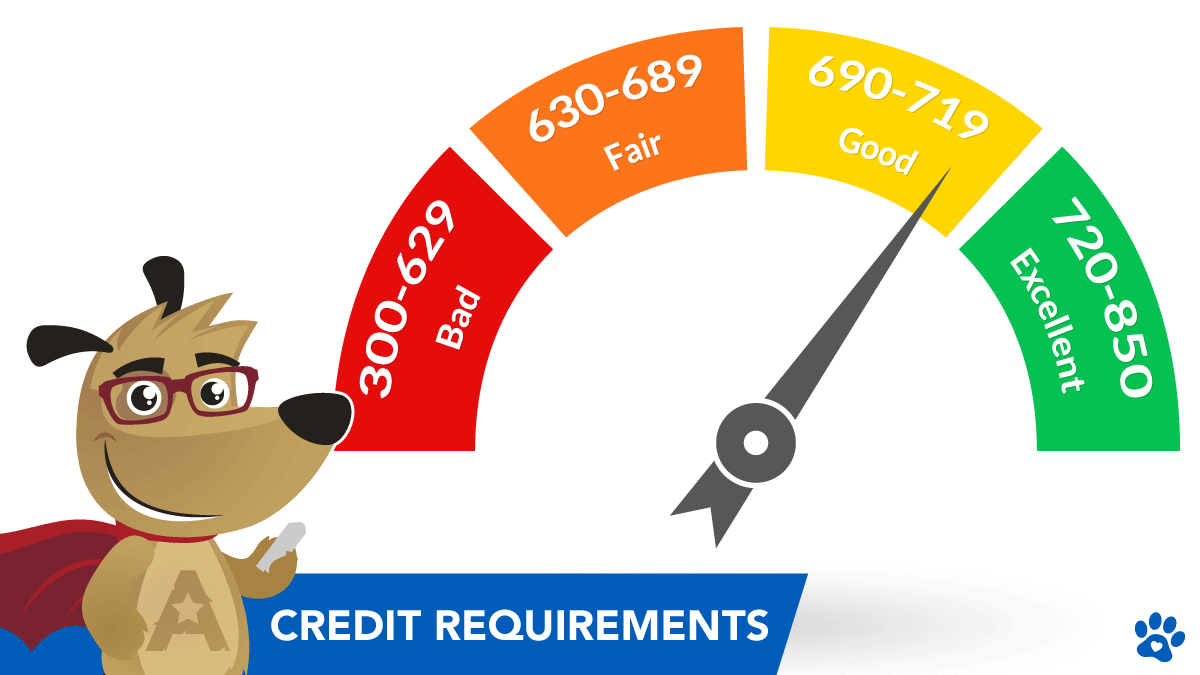

Credit Requirements For A Reverse Mortgage In 2023

Closing Costs Calculator Estimate Closing Costs At Bank Of America

Century Communities Inc 2021 Annual Report

Usda Loans American Mortgage Services Tampa Fl

Digital Mortgage 2017 National Mortgage News Conferences

Mortgage Broker Toronto Mortgage Scout Inc

Can You Roll Your Closing Costs Into Your Mortgage The Motley Fool

Warehouse Processing Homeowner Insurance Products Jumbo And Non Qm News Credit Suisse Mbs Settlement

The Pros And Cons Of A 40 Year Mortgage Rocket Mortgage

What To Consider When Rolling Your Closing Costs Into A Mortgage Loan

40 Mortgage Closing Illustrations Royalty Free Vector Graphics Clip Art Istock Mortgage Closing Costs

Refinancing A Mortgage During Covid 19 Ratesdotca

How To Finance Your Closing Costs The Mortgage Reports

Are Closing Costs Included In A Mortgage

How To Get A Seller Credit What You Need To Know Getloans Com